When it comes to insurance brokers, it’s fair to say the choices of companies are vast. It’s not quite Starbucks level of regularity, but there are certainly more than a few. Which is why it takes plenty of hard work to build a successful reputation.

Green Insurance Group has created its legacy on personal relationships with their customers. They have reaped the reweds too with an astonishingly high retention of 93 percent.

We recently sat down with Glen Gillam, Sales Director at Green Insurance Group, to talk about the company ethos and how software has impacted the setups across their six branches.

The Interview

Simon: Hi Glen, thanks for taking the time to talk to me today. Tell us a bit about Green Insurance Group and your journey to becoming a sales director.

Glen: I’ve been in insurance for 27 years and have worked at Green Insurance for around 14 years. I joined as a Commercial Director and have been Sales Director for the last few years.

We are now part of a larger group called Global Risk Partners (GRP). Green Insurance control about £30 million in premiums (amount a business or person needs to pay in insurance) and GRP is over £600 million – they are a big organization.

On our behalf, and with our help, they negotiate exclusive products with insurers that enables us to have a product we can provide to the customer—one they might not get with our competitors.

Simon: How many people directly work for Green Insurance Group, and how many of those are in sales?

Glen: We are an expanding company that predominantly grows by acquisition. At the moment, we have 85 staff members. Of that 85, I would argue that every person has a sales function. I think the traditional role of one person doing sales is a challenging one to be successful in these days.

Every member of my staff has an understanding of the sales process. Regarding the people that I regularly sit down with and review their sales activities, I would say it’s around 40 commercial staff.

Simon: Are you a specialized insurance brokers or more general?

Glen: We are general insurance brokers who can insure most things from a private motor to multi-purpose manufacturing risks.

Simon: Tell us a bit about Green Insurance’s setup and how you go about acquiring customers

Glen: About three or four years ago I sat down and reviewed our process. We have always grown by acquisition and recommendation but had no real process in place to win new clients.

From a cost-effective point of view, if you acquire a broker, you’re buying the broker and the relationships with their customers. We’ve always been quite successful at going down the acquisition route.

Then we decided to focus on how we could attract new clients to us to ensure we continue to grow by filling the gap for when we do lose business—although we do have a high retention rate of 93 percent.

We do tend to hang onto our clients, but we are always looking at ways we can improve our processes. The aim was to develop these further and continue to replace what we lose and grow so there is plenty of room for new customers.

You still need to aim to fill up that last seven percent and hopefully exceed it.

Simon: How did you prospect for that extra seven percent?

Glen: First, I sat down with all the Account Executives . The problem was that each one did things differently. Some had prospect lists on bits of paper or in spreadsheets, others relied on our broking system diary.

It was all fragmented and easy to lose if that member of staff left, which meant I had to find a way to bring everyone’s prospects together so we could work in unison.

Initially, we decided to go down the spreadsheet route, using Excel to curate our prospecting lists. That was basically how our process was born.

Simon: How did using Excel sheets for prospecting work for you?

Glen: There is no transparency with spreadsheets. It’s hard for me to file reports from so many different ones. I was finding it difficult to report to the rest of the board on what was happening with sales and to plan effectively.

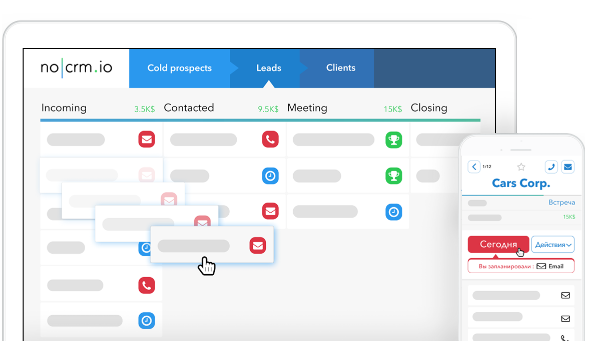

I started looking for a sales software, one that was reasonably priced as I needed to build a business case. I did look at Salesforce, but it was expensive. I was also aware that I didn’t want to create a process for its own sake and that any system would have to be quick and easy to use.

If you’re going to change the culture, you have to implement a tool that staff want to use. Not something that burdens them. We needed to keep it simple.

Simon: Is this where noCRM.io came in?

Glen: Yes. To start with, we piloted it across one branch. After a successful period, I’ve now got all my staff who actively do commercial quotes using the software.

Simon: How does it fit into your process?

Glen: All commercial quotes are recorded on the system but we also started using it to prospect our “lost clients list”. We used the system to get our “Winbacks”, those who had either gone elsewhere or stopped using Green Insurance.

I uploaded the lists of lost business along with the old quote spreadsheets onto the system and asked the branch managers to filter them. I think with the benefit of hindsight we should have spent more time making sure those lists were good leads before entering everything into the system at once. But you live and learn.

Using dedicated sales software helped to shift the mindset. You need to change people’s habits when you’re trying to change the culture. It’s about getting them to change the way they do things but incorporate sales into their everyday workflow.

Simon: How has the system benefited you ?

At any one time I can see what my staff are doing in the sales process. I can see which quotes are outstanding, what prospects they are looking at and all the activity around it. This allows me to more effectively manage and predict our new business.

For example, I can produce a report which identifies the number of cases and value at each step noted in the system. It helps us know exactly what is coming through and what is in the pipeline and reduce the guesswork.

Simon: You talk about the pipeline. Did you have your own specific steps for each section of the pipe?

Glen: Yes, we have tailored the system to reflect the steps we have in our quote lifecycle. This enables me to see where we are at a glance.

At the moment, it’s still baby steps, as an awful lot of our business comes from recommendations—what I would class as “walk-in business”. Our clients recommend us to other people, and that accounts for about 75 percent of our new business.

I also use tags to identify the source of new enquiries, which lets me know which areas our efforts are best spent.

The real difference is that we have a more controlled way to keep track of the quote process and forecast results. We have a sales plan, which we are breaking down and implementing into the six branches so everyone is completely clear of targets and what we expect of them.

Simon: How are those six branches structured? Is each one for different insurance options or is it geographical based?

Glen: It’s purely geographical. We have branches in Kent, Sussex and London. Most have come through acquisitions where we acquire a broker in a particular area.

Brand Identity

Simon: Would you say that, as an insurance broker, there is anything that sets you apart in the market? Or is it a case of everyone having enough room to operate?

Glen: In terms of what we do differently, we might not all be the traditional salespeople, but when you’re dealing with insurance, it’s vital to have exclusive bespoke products and believe in them. The result means that you should find it easy to advise clients and know that what you’re offering meets their expectations and needs.

When we talk to existing customers, I wouldn’t speak about a product I have unless I felt they needed it and it benefited them. Much of that comes down to listening to their needs and matching them with our solutions.

I often say to my team that, whilst we may feel we are not salespeople, it’s our role to make customers aware of the areas of cover that they don’t have but should have.

As long as you have integrity, understand your product and can talk from a position of knowledge, I would hope that when we sit down with customers that haven’t dealt with us before, they might see something a bit different regarding the staff we have and how they talk to clients.

Simon: It’s really about listening to your customers and providing a service, rather than the “sell at costs” stereotype some industries get labelled with?

Glen: I think maybe, many years ago, people might not have been as upfront. We take time to speak with customers and understand their needs. I’ve occasionally said to customers before that if they think they already have a good cover with someone else, I won’t try to move them over to our products. What I can do, however, is offer advice, identify gaps in their cover and show that we can add value in ways maybe their current broker doesn’t.

It’s about giving the right advice to customers and selling the company and its legacy, rather than just the product itself. It’s not always about the obvious sale and the old “close that sale” method. I like to think that those days are gone. The market we deal with is about providing long term relationships built on trust.

We’re selling an annually renewable contract. It’s vital that we build trust and provide the best options for the client.

Simon: I know you said everyone plays a role in sales, but are there areas where it’s segmented? Do you have specific people for cold calling and another for closing, for example?

Glen: At the moment, we have Account Execs. These are people that will physically go and see a customer. Then we have the team in the office that have their own clients and offer support. The Account Execs are the ones on the more substantial cases and handle face-to-face meetings.

The rest of the team also deal with incoming inquiries. Regarding outward calls, we’re still going through our list from the last 5-10 years, working on the Winbacks. All staff are contacting these prospects.

As insurance products develop and launch, there is also another ongoing campaign dealing with cross-selling and identifying gaps in cover to existing customers who we don’t see regularly face to face. We don’t see a significant proportion of our client base face-to-face—much of that is via phone and email.

What we are trying to do is make sure that we contact all of those clients and have that conversation with them about products they don’t have but might want to explore. For example, Cyber Insurance.

We do very little cold calling. These are old and existing clients. There are some cold calling list, but because of the low win rate on those, they aren’t a priority. We focus on recommendations and previous clients currently. This is changing, however.

Simon: It’s mainly about selling extra services to current customers, then?

Glen: Exactly. Also, I think we’re quite British and, in the past, we haven’t sat down with our customers and asked them to promote us to their network. We are developing that side of things, making the most out of the good relationships that we already hold—without abusing them, of course.

That way our recommendation rate increases because word of mouth is still such a powerful selling tool, even in a day and age where everything is done digitally.

Simon: Do you have a regular sales catch up? How do you reward staff for their success?

Glen: Some branches I see face-to-face every month others bi-monthly. I sit down with the Account Execs and branch managers.

While the branch meetings are still relevant, having a sales system means I can see what is going on with each branch without leaving my desk. I get an email every time someone wins some business, and I think it’s important to acknowledge their achievement.

Things that we weren’t doing before—gentle recognition for their hard work. It makes a big difference to the mentality and culture. People feel recognised for their hard work and, in turn, feel motivated to perform even better.

Simon: I couldn’t agree more. With software, do you use anything else to empower your salespeople?

Glen: We use Open GI, which is essentially a CRM for brokers. Open GI comes after using lead management software. It does have something called “advanced prospect managers”, but it’s costly and not easy to setup.

We like the idea of using lead management software as a pre-CRM, rather than combining the two. It makes the process easier, and each software is designed specifically for what it’s supposed to do.

Salespeople and the Industry

Simon: What traits do you look for in salespeople

Glen: First and foremost, they need to be able to get on with people. We are a friendly team, and we want new members of staff to integrate well into that team. We also need them to know the products and have integrity.

As I said earlier, I would walk away from a sale if I didn’t think that it was the right product for the customers. Anyone we hire needs to share our ethos. Our reputation is everything. If we get it wrong, we won’t have a business.

When I hire someone, I need to make sure they will fit into our new culture and will work with the same mentality.

Simon: When it comes to losing out on sale, does your staff have a process for what happens if you don’t pick it up.

Glen: It comes down to the fit of the customer and the trust you have in your staff. I have a lot of faith in my team. I let them decide if it’s something we want to look again at in 6 months to a year’s time when their renewal is up. Or if it’s a case that it’s not a good business fit.

Simon: How would you say the industry has changed in the last 10 years?

Glen: There are a couple of things. One is the centralization of insurance companies. An insurance company will have centers for a particular process, whereas before it was all under one roof.

But now they have shut local branches. If the insurers close their branches and centralize everything, that makes it difficult to maintain relationships.

Ultimately, I understand its about managing costs, and technology helps this process, so it’s not all bad. Tech provides a way for instant communication, wherever you’re based. But maybe a little bit of that relationship has gone.

When I first started, the claims, accounts and commercial and personal were all in one building. You could go into the building and talk to the people you needed to on that day.

But now, you’ll speak to claims in the Midlands and accounts in London—it’s very fragmented. It comes down to managing costs, which technology is helping them do.

Simon: You must have seen many changes over the years in working setups

Glen: I’ve seen a fair few changes. We started scanning documents in 2007, which was somewhat of a revolution at the time. Before that, it was mainly client folders and ring binders scattered all over the desk, with the pile height representing a badge of honor for the amount of work you had.

Now the scanning is part of our primary broking system, Open GI, which makes life easier and your desk much clearer. It might sound pretty obvious suggesting that everything is done on computers now, but at the time it was a significant transition and changed the way we operated.

Simon: Last question, what advice would you give to salespeople

Glen: You have to believe in your product. If you don’t believe in it, how can you be genuine when you’re talking to someone and help them understand that they need it?

If I’m sitting with a customer, telling them they need the product; I need to believe in my heart that’s right. If I don’t, I shouldn’t be having that conversation.

Simon: Thank you for taking the time out to talk with me today.

Glen: No problem at all

Related Reading

How Lorenzo Automotores Uses noCRM.io in the Automobile Industry